Updated: Todayonline 16 Sep 2011

UBS shares plummeted by 8 per cent to 10.07 Swiss francs late yesterday in Zurich, even as the European banking sector surged on news that central banks would provide additional liquidity to prevent the money markets from seizing up.

The share price plunge is bad news for GIC, which holds a 6.4-per-cent stake in the Swiss bank. Based on the last traded price, GIC is sitting on about 7 billion francs, or S$10 billion, in unrealized losses, even after taking into account the 2 billion francs it received on the coupon before its 2008 investment was converted to shares last year.

A GIC spokesperson yesterday declined to comment when contacted by Today.

Updated: Bloomberg 27Sep2011

Government of Singapore Investment Corp. faces a 6.7 billion Swiss franc ($7.4 billion) loss as the biggest investor of UBS AG (UBSN), topping unprofitable banking investments by the city’s sovereign wealth firms since 2007.

GIC also has about $500 million of unrealized losses on its Citigroup Inc. (C) stake, according to Bloomberg calculations. Temasek Holdings Pte, Singapore’s other state investment company, divested shares in Bank of America Corp. (BAC) and Barclays Plc (BARC) at losses more than two years ago.

“from a Singapore Inc. perspective, with the two sovereign wealth funds not coordinating, I feel they have overinvested in the financial sector.” – PAP MP Inderjit Singh

“This (GIC’s annual reports should reflect its yearly performance) will increase transparency and accountability to Singaporeans, who are the ultimate stakeholders and beneficiaries of the investments,” Opposition MP Chen Show-Mao

Updated 10 Oct 2011:

Singapore’s foreign exchange reserves stood at US$233.62 billion at the end of Sep 2011 (Todayonline). How much do we really have in our kitty? you will be very confused when a professor reported: “”Using Singaporean provided numbers on budget surpluses, borrowing, and returns: Singapore, Inc. should have more than $2.1 trillion SGD in the bank right now. TRILLION. RIGHT NOW!! It currently reports only about $700 billion SGD.” (Source) So our reserve is US$233m, SGD$700m or Trillions?

Updated 20Feb2013: Todayonline reported that Temasek Holding manages about S$198 billion fund.

[Updated 31 Jul 2013] Askmelah finally found the answer, the official reserve that Singapore has can be found here: http://www.mas.gov.sg/statistics/reserve-statistics/official-foreign-reserves.aspx

[Updated 4 Jul 2016]

[Updated 15 Jul 2016] “the estimated combined holdings of these two companies (GIC and TH) top out at over (SGD)$730 billion.” – source: dollarsandsense.sg

Related topics:

- The Wisest Man in the Cabinet-Tharman Shanmugaratnam

- Lift GIC’s cloud of opacity

- Temasek and Singapore Puzzle – Is it another Madoff crisis in making?

- Singapore Inc – Just When You Thought it Couldn’t Get Any Worse

- S’pore GP: Full disclosure, please

- 20140717 No reason for MPs and GIC to be afraid of CPF transparency issue

- Go beyond Tharman’s words and open up archives to public

- Why I do not trust GIC to manage my CPF

- Temasek Holdings And GIC – And The Management Of Our Monies –

“The downside to our SWFs, besides not being flushed with cash, is that Singaporeans, even after looking through websites and reports, still mostly have no idea what Temasek Holdings and GIC do with the country’s money. They are just looked upon as giant companies linked to the government that are shrouded in mystery. And as such, most people sit quietly when things are looking good, and complain when they lose value at their year ends. And GIC doesn’t publish their results.” – Source

Transparency on our Sovereign Wealth Fund

The National Solidarity Party (NSP) regrets the continued lack of transparency surrounding our sovereign wealth funds (SWFs). The NSP believes that sufficient public information in the internal workings of GIC and Temasek Holdings is undoubtedly in the interest of all Singaporeans, as is a demonstrably robust system of check and balances in the management of our SWFs.

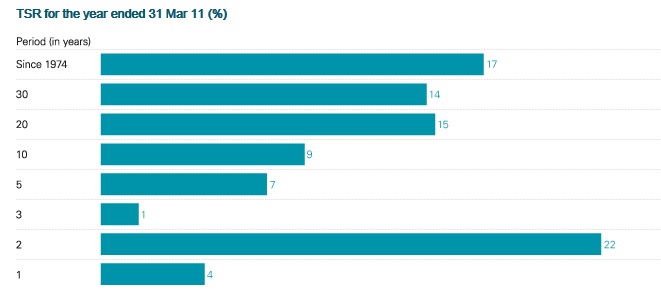

Singapore’s reserves, as well as Singaporeans’ Central Provident Fund (CPF) contributions, are managed by GIC and Temasek Holdings. In GIC’s 2011 annual report, released last month, the fund claims a 7.2% annualized rate of return in USD terms from its investments over the past 20 years. Converted to SGD terms, the annualised rate of return is 5.1%. Temasek Holdings claims annualized returns of 15% over 20 years. In comparison, CPF only pays out 2.5%. It is also a disturbing state of affairs when Temasek Holdings, with about 400 employees, can report an $8 billion administrative expense without incurring significant public scrutiny. To put it in context, $8 billion is more than one-sixth of our national budget.

The NSP believes that, as a mature, intelligent and financially responsible society, our citizens have the unquestionable right to have the fullest picture of where their taxes and government mandated social contributions go into and what comes out of that. Therefore, we strongly encourage greater public awareness of relevant benchmarks such as Malaysia’s Employees Provident Fund, which guarantees a minimum return of 2.5% p.a. and actually delivered returns of 4% to 8.5% annually since 1960 , and Norway’s SWF which has managed to be highly successful while offering greater disclosure to its citizens.

The longstanding excuse from the privileged few responsible for maintaining the shroud of secrecy around our SWFs is that secrecy aids competitiveness. PAP leader and long-serving former GIC Chairman Lee Kuan Yew has argued that if GIC makes its moves clear, competitors can predict what it does next. We believe that this argument is specious. There is a world of difference between GIC being transparent to stakeholders (which Singapore taxpayers surely are) on one hand, and foolishly telegraphing its investment strategy to competitors. There are plenty of examples of successful public companies that manage to turn in consistently good returns for stakeholders while providing full disclosure to stakeholders. Where our SWFs are concerned, as we can see from the paltry interest rates offered by CPF, Singapore taxpayers neither enjoy full disclosure nor noticeably remarkable returns.

The NSP also calls for all MPs and their immediate relatives to be open about any compensation that they might be receiving from Temasek Holdings or GIC or other such organizations. The ongoing review on ministerial salaries is a correct, if belated, move in the right direction. But it is only a partial step. For example, existing and former MPs such as Lee Kuan Yew, Lee Hsien Loong and Tony Tan have served many years in a chairman or deputy chairman role with GIC or Temasek. Close relatives of these PAP dignitaries are also serving in high positions within the SWFs. Additionally, with so many PAP MPs also juggling multiple, sometimes dozens, of directorships and consultancies, it is clearly in the public interest to know who else is paying their MPs and for what purposes.

We strongly recommend that serving MPs offer a full and public disclosure on all remunerated positions, including directorships and retainers, taken out with the official MP position.

NSP firmly believes that better financial transparency in our SWFs and Parliament is the best way to serve all Singaporeans, and hope that the new elected President will champion the move as this relates also to the management of our reserves.

Hazel Poa

Secretary-General

National Solidarity Party

WE REFER to the article “NSP wants GIC, Temasek to be more transparent” (The Straits Times, Aug 23) on Ms Hazel Poa’s misleading statements on Temasek.

First, Temasek does not manage or invest any CPF money, or the foreign reserves of Singapore.

Second, Temasek is a responsible long-term investor with reporting standards that well exceed globally recognised yardsticks such as the Santiago Principles, which were jointly developed by sovereign investors and the IMF.

Our annual Temasek Review reports a summary of key financials, as well as investment returns to our shareholder over different time periods from one year to over three decades, and other relevant information such as our governance principles, portfolio composition and risks. The latest Temasek Review 2011 is available at www.temasekreview.com.sg for public scrutiny. Previous reports are also available on our online media centre at www.temasek.com.sg.

Last year, we further published highlights of Temasek Review in our local newspapers to help report our business and performance to a wider audience. This year, we expanded this initiative to 11 local and international newspapers, such as The Straits Times and Financial Times, as well as online news portals such as Yahoo News.

Third, Ms Poa is mistaken about the “S$8 billion administrative expense” on two counts. As reported in our latest Temasek Review 2011, our group administrative expense was S$7 billion last year, not S$8 billion which was reported for the year before. This also included expenses of subsidiary companies such Singapore Airlines, PSA and others, and not for Temasek Holdings only.

We take this opportunity to reassure our broader public as well as Ms Poa that we are keen to expand our stakeholder base in a responsible, prudent and measured manner.

We are credit rated AAA/Aaa by internationally recognised rating agencies, and have offered top rated Temasek Bonds to both international and Singapore investors since 2005.

These initiatives, from our annual Temasek Review to our bond issuances, are part of our efforts to build a professional and responsible investment firm to deliver sustainable long term returns to our broader stakeholder base.

Tony Tan lost nearly S$60 billion dollars as Deputy Chairman of GIC in 2008

Source: Termasekreview 19 Aug 2011

Despite his constant trumpeting of his financial knowledge and experience, Tony Tan’s ‘track record’ at Government of Investment Corporation (GIC) was far from impressive.

In January 2008, just when investors are shorting U.S. banks due to shaky fundamentals, Tony Tan, then Deputy Chairman of GIC poured in billions of dollars of taxpayers’ monies to take a stake in U.S. banking giant Citigroup and Swiss bank UBS.

Explaining the rationale for the two investments shortly after the closure of the Citigroup deal, Dr Tan acknowledged that both “are out of character for GIC”, which, he said, prefers to be more of a portfolio investor.

However, what prompted GIC to invest in UBS and Citigroup was “a very unusual situation in US and European financial stocks, where a combination of events… have all come together to create a situation where even sound banks like UBS and Citigroup are temporarily facing significant problems. But their franchises are strong”.

“In the case of UBS, they have a worldwide global wealth management business which is something not replicable by any bank. Citigroup has an international worldwide consumer business which is also unique…,” Tony Tan said in an interview with the Business Times.

He added that that the terms on which the two deals were negotiated were fair.

“We do not think that they are unduly favourable to GIC…GIC is not seeking to take advantage of anyone”.

GIC’s shocking decision to invest in Citigroup was greeted with horror by many economists and investors, including U.S. investment guru Jims Roger who said he felt ’sad’ for Singapore as it would be losing alot of money:

“They’re making a big mistake; these banks have many more problems still ahead. They should wait until these companies are really on the ropes a few years from now . . . and trading at $5 a share.”

He also expressed doubts about the capability of GIC’s fund managers, including Tony Tan:

“I know these people, and they have never given me the impression that they’re smarter than anyone else…They have gigantic amounts of money, but they’ve made a bad judgment in these cases.” (read more here)

A few months later, the value of GIC’s shares in Citigroup and UBS crashed after both got mired in toxic debts during the 2008 global financial crisis. The news was censored by the Singapore media, but Wall Street Journal reported that GIC suffered a loss around 59 billion Singapore dollars (US$41.6 billion) in the fiscal year ended March, making it one of the worst years for the sovereign wealth fund since it was established in 1981.

The amount of public monies lost by Tony Tan in less than a year is just sufficient to finance Mr Tan Jee Say’s National Regeneration Plan to regenerate Singapore’s economy over five years.

Recent Comments